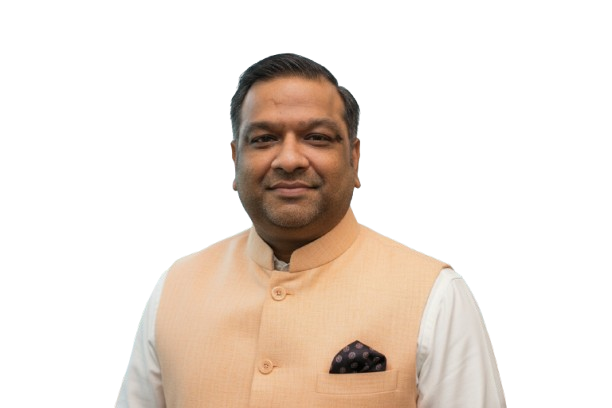

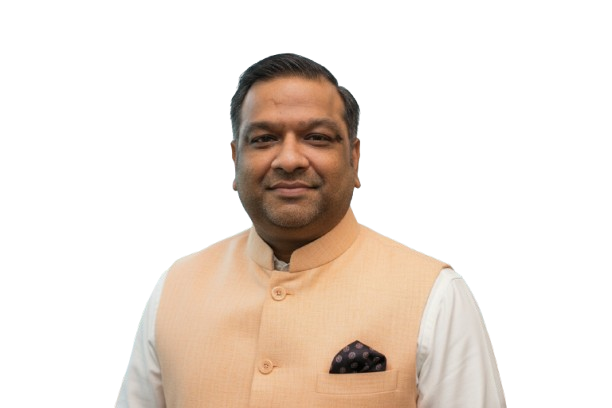

Tarun Bansal (Savingwala)

From Pitampura to the rest of North Delhi, I help families secure their futures through expert Mutual Fund advisory and Life, Health & Motor Insurance.

From Pitampura to the rest of North Delhi, I help families secure their futures through expert Mutual Fund advisory and Life, Health & Motor Insurance.